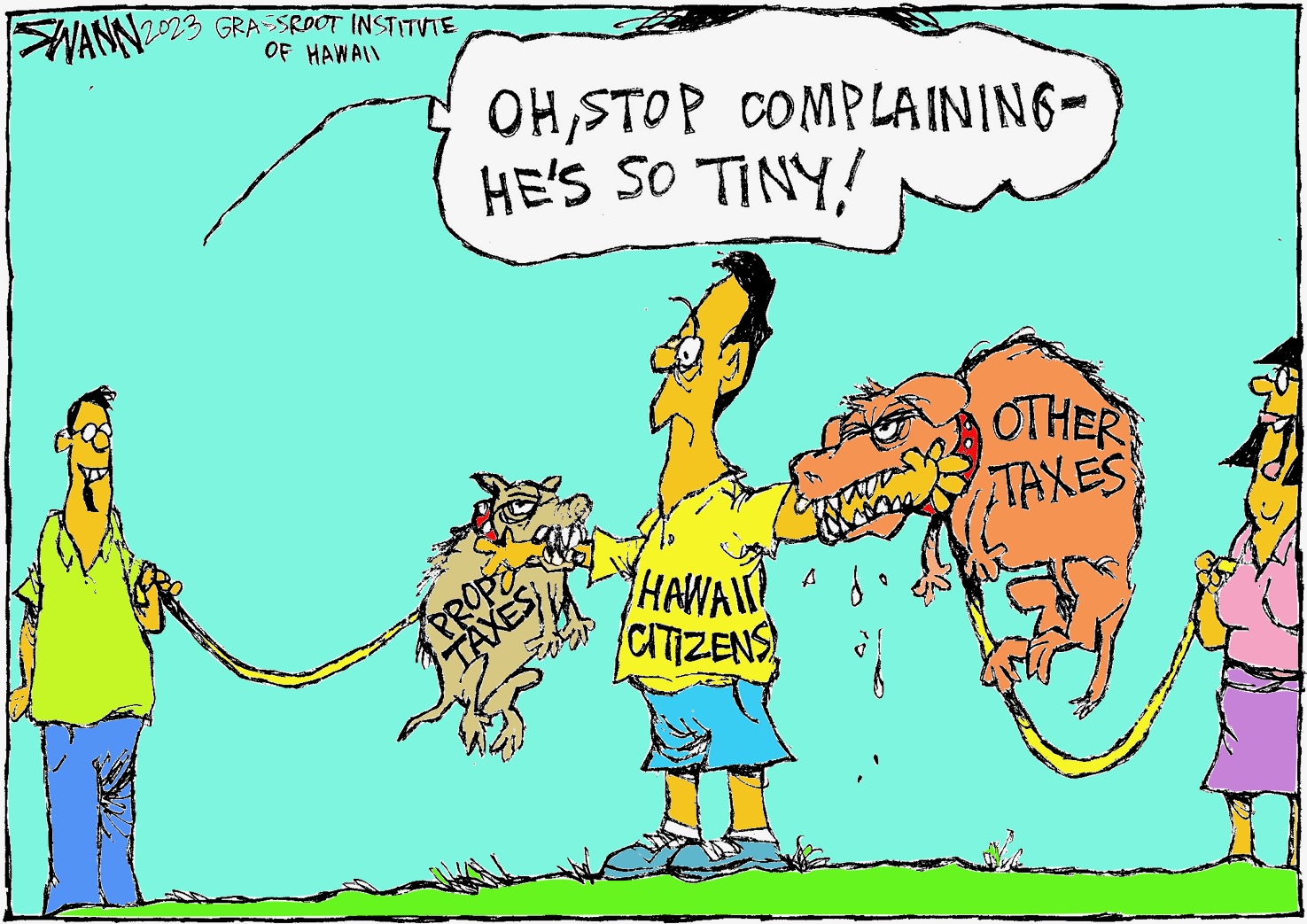

Bill 2900: Annual adjustment of property tax tiers benefits all

from Grassroot Institute

The following testimony was submitted by the Grassroot Institute of Hawaii for consideration by the Kauai County Council on June 14, 2023.

June 14, 2023

8:25 a.m.

Kauai County Council Chambers

To: Kaua‘i County Council

Councilmember Mel Rapozo, Chair

Councilmember KipuKai Kuali`i, Vice Chair

From: Grassroot Institute of Hawaii

Jonathan Helton, Policy Researcher

RE: Bill 2900 — RELATING TO REAL PROPERTY TAX

Comments Only

Dear Chair and Council Members:

The Grassroot Institute of Hawaii would like to offer its comments on Bill 2900, which would abolish the “Residential Investor” tax class, rename several other tax classes and implement value tiers for all remaining tax classes. These changes would take effect for the tax year beginning July 1, 2024.

Property tax tiers would give the County the ability to enact more targeted rate changes on an annual basis, although they could also lead to higher taxes overall if rates are set too high.

Mainly, though, the Institute appreciates the bill’s language that would allow the Council to adjust the value tiers every year — a process Maui County already uses.

This should hopefully help the county avoid Oahu’s “Residential A” problem and the current problem with the $1.3 million Residential Investor threshold.

On Oahu, the Residential A tax class covers all residential properties valued at $1 million or more, including second homes, long-term rentals and owner-occupied properties for which the owner has not filed a homeowner exemption.

Honolulu set the tier by ordinance at $1 million in 2018 and has yet to update it. We all know how much the real estate market has changed since then. This situation has left the owners of many long-term rentals stuck with much higher tax bills simply because of Hawaii’s hot real estate market.

Changing the tiers every year in response to changes in assessed values should hopefully keep Kauai families, farmers and businesses from shouldering dramatically higher tax bills.

Thank you for the opportunity to testify.

Sincerely,

Jonathan Helton

Policy Researcher

Grassroot Institute of Hawaii